ESG

Sustainable Investing Newsletter published on April 20, 2021

Sustainable Bond Innovations Spark Issuance, Boost Transparency

The sustainable bond market is benefiting from innovation that is expanding the availability and enhancing the transparency of debt issued to finance environmental, social and governance (ESG) progress. As with many ESG-related advances, the European market, along with money center banks are responsible for propelling recent growth, but the sustainable bond movement has been well underway for some time.

Issuers of sustainable bonds—including recently offered sustainability-linked bonds and credit facilities—either use proceeds for eligible projects or to improve ESG metrics or performance. Exhibit 1 presents a summary of the types of ESG-linked bonds and use of proceeds found in the market today. More recently, innovative issue covenants and terms are enhancing investors’ views into an issuer’s progress toward specific ESG goals linked to bond interest rates.

Sustainable Bond Market Growth, Innovation Continues

The sustainable bond market has undoubtedly evolved since our last update on the financing vehicle in 2018. For one, the market is no longer called green, but uses the broader sustainable moniker to capture the use of the social and sustainability bond labels. Today, four powerful forces drive growing sustainable bond volumes: 1) market and, often, regulatory mandates to address sustainability including Net-Zero and carbon transition goals 2) increased corporate bond issuance to finance sustainable projects, 3) surging investor demand for sustainable bonds and, more recently 4) innovative approaches to debt issuance that ties interest rates to the sustainability initiatives. As the Biden administration advances its own sustainability related legislative and regulatory initiatives, issuance could be further supported (See Changed Power Structure in DC May Support Environmental Initiatives).

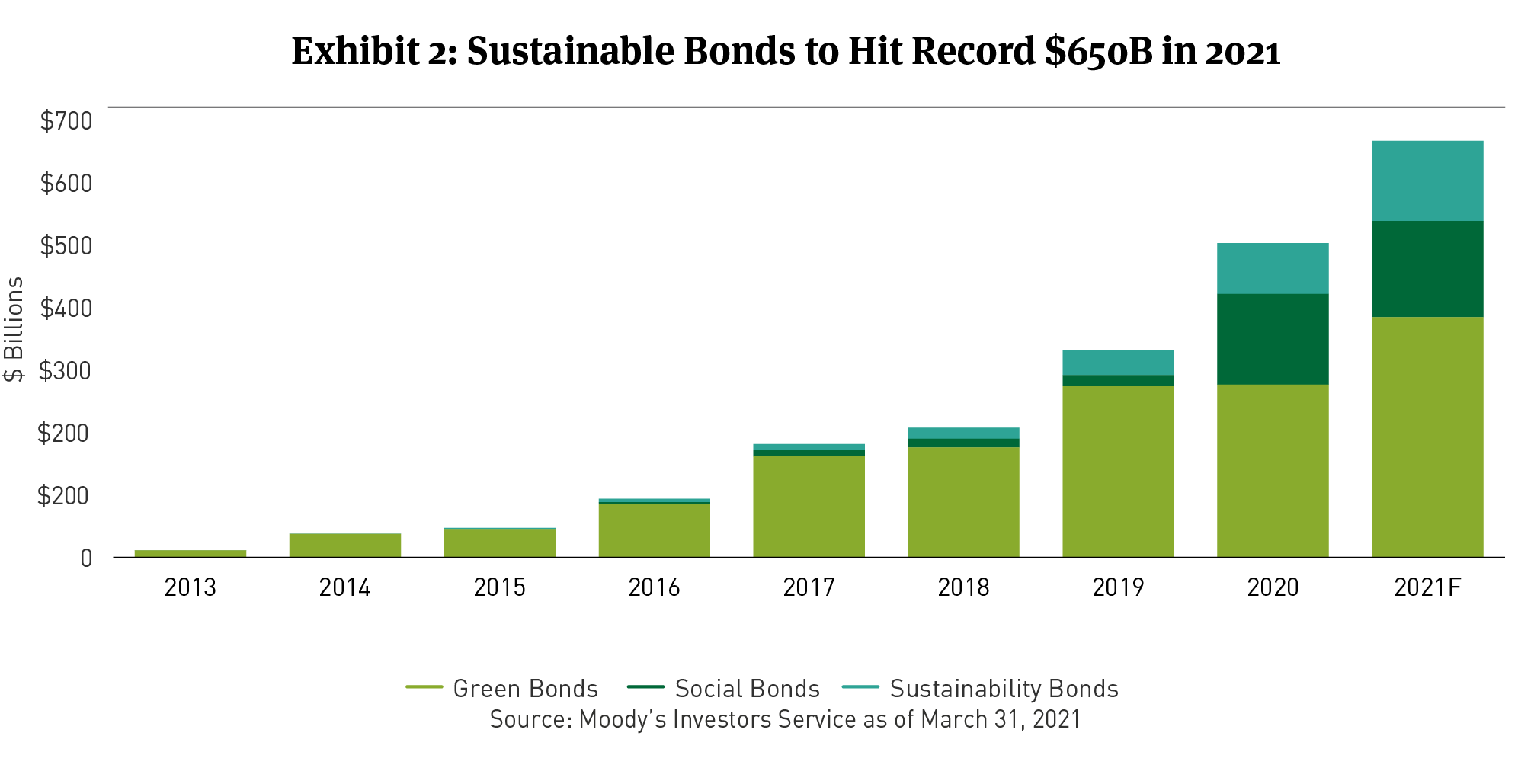

Growth in the market continues to accelerate. Consider that Breckinridge purchased its first green bond in 2013. That year $11.3 billion in green-label bonds were issued globally or only $5.4 billion in U.S. dollar denominated transactions, according to Moody’s. At that time, the only sustainable label used in the market was green, to signify that it was meant to finance environmentally beneficial projects.

Issuance of use-of-proceeds sustainable bonds—with proceeds earmarked for sustainable projects—soared to $491 billion in 2020, per Moody’s (See Exhibit 2). Today, in addition to the green label, issuers use the social and sustainability bond labels to finance ESG projects. Sustainability labeled bonds in U.S. dollar issuance also continued to expand in 2020, to a record $137.8 billion. (See Exhibit 3). Moody’s predicts sustainable bond issuance globally may grow by 32 percent in 2021 to $650 billion. Importantly, although U.S. Dollar-denominated (USD) issuance reached a record level in 2020, its share of total global issuance dipped to 31%, which is the lowest since 2014.

In 2021, ESG-related bank-issued bonds already have seen increased issuance and investor interest.

JP Morgan’s first ever social bond totaled $1 billion to provide financing in three target areas, small businesses and access to education and health care in low- and moderate-income geographies and affordable housing.

Citigroup issued a $2.5 billion social bond targeting affordable housing. In its 2019 Corporate Sustainability Report, the bank detailed affordable housing’s place in its ESG goals. The bond framework described use of proceeds, and financing- or refinancing-eligible projects. Lastly, the deal details internal and external evaluation, reporting and auditing of management of proceeds.

Goldman Sachs issued an $800 million sustainability bond to accelerate climate transition and advance inclusive growth across nine themes including clean energy and sustainable food and agriculture. The bank intends to issue a sustainable bond every 12 to 18 months with a goal of financing $750 billion in sustainable projects by 2030.

New Developments in Sustainability-Linked Bonds and Credit Facilities

Not counted in Moody’s $650 billion global sustainable bond estimate for 2021 is a relatively new financing vehicle called the sustainability-linked bond. These bonds are structured to penalize issuers, and further compensate investors, if preset goals, such as a reduction in GHG emissions, are not reached during the term of the bond. They were a modest $8.9 billion in 2020. However, JP Morgan believes this type of fixed income investment is the next frontier for sustainable finance, predicting bonds tied directly to corporate ESG goals could reach $150 billion this year.1

Goldman Sachs with the $750 billion sustainable finance goal brought to market in September 2019 the first ever sustainability-linked bond issued by an Italian energy company. The bond issuer pledges to achieve its renewable energy goal by 2021. If it is not reached on time, the bond’s coupon steps up 25 basis points for the life of the bond.

Trends suggest continued growth in sustainability-linked bonds and loan facilities. A French oil and gas company with $60 billion in debt outstanding demonstrated its commitment to energy transition with a plan to link all future bonds issued to audited climate targets.

In March 2021, a global beverage company closed on a $10.1 billion sustainability-linked credit facility. It has a five-year loan term and a pricing mechanism that encourages improved sustainability performance in four categories, including improving water efficiency and reducing greenhouse gas emissions, that contribute to its 2025 sustainability goals.

Investment Analysis Still Key to Assessing Value, Impact

When considered within the context of criticisms of greenwashing among a few security issuers, clear metrics associated with sustainability-linked bonds and credit facilities crystallize for investors the use of proceeds and performance metrics goals that investors can identify and monitor. Investors may pay a greenium on some sustainable bonds in the primary and secondary markets based on limited new issue supply and excess investor demand. To ensure the yield premium is warranted, investors should be fully confident in the use of proceeds.

In the European Union, a Green Taxonomy establishes a list of environmentally sustainable economic activities and a Green Bond Standard offers substance and enforcement to sustainable bonds. Such regulatory oversight does not currently exist in the U.S., leaving it primarily to investors to analyze and understand how the bonds and their proceeds fit into the broader ESG considerations of the issuing entity. In the U.S., the International Capital Market Association’s ESG-related issuance guidelines are perhaps the best guidelines, but they fall short of regulatory or legislative standards.

Breckinridge Sustainable Bond Analysis Seeks Transparency, Clarity

When considering a sustainable bond for investment, Breckinridge analysts look for clear statements of objectives and use of proceeds. Fundamental and ESG analysis of every corporate and municipal bond we consider for purchase is essential to identifying risks and opportunities. Beyond that essential research, Breckinridge engages with leaders at organizations issuing bonds to better grasp how they seek to enhance ESG performance and how sustainable bonds will finance that progress.

Our integrated security research and ongoing engagement efforts help us to better identify ESG financing and goals alignment, explore use-of-proceeds commitments to identify effective auditing and compliance metrics and consider relative value and whether a premium exists in an issuer’s sustainable bonds as compared to its non-labelled bonds.

USD Supply: Growing but Still Challenged

There is growing interest in strategies dedicated to investing in sustainable and sustainability-linked bonds. The securities are appealing to investors with a sustainable focus given their transparency on use of proceeds and targeted environmental and social objectives.

Currently, in our view, still relatively limited new issue supply in USD across sectors and costs—specifically, the prevalence of sustainable bond spread premiums—detract from the practicality of a portfolio that invests only in sustainable bonds and favor inclusion in a more diverse portfolio of corporate bonds.

This could change over time, particularly if all major corporate bond sectors were to contain a significant amount of sustainable bonds and spread premiums were to subside as scarcity value could wane in the face of increased supply.

That said, we remain true to our investment philosophy and mandate: closely monitor the market, actively participate in sustainable bond issuer roadshows, and selectively invest in sustainable bonds when the security meets our portfolio management and research standards and requirements.

[1] Moody’s Investors Service.

[2] JP Morgan’s ESG Debt Head Expects Sustainability-Linked Bond Boom, Bloomberg, February 4, 2021. Available here: https://www.bloomberg.com/news/articles/2021-02-04/jpmorgan-s-esg-debt-head-expects-sustainability-linked-bond-boom.

DISCLAIMER

This material provides general and/or educational information and should not be construed as a solicitation or offer of Breckinridge services or products or as legal, tax or investment advice. The content is current as of the time of writing or as designated within the material. All information, including the opinions and views of Breckinridge, is subject to change without notice.

Any estimates, targets, and projections are based on Breckinridge research, analysis, and assumptions. No assurances can be made that any such estimate, target or projection will be accurate; actual results may differ substantially.

Past performance is not a guarantee of future results. Breckinridge makes no assurances, warranties or representations that any strategies described herein will meet their investment objectives or incur any profits. Any index results shown are for illustrative purposes and do not represent the performance of any specific investment. Indices are unmanaged and investors cannot directly invest in them. They do not reflect any management, custody, transaction or other expenses, and generally assume reinvestment of dividends, income and capital gains. Performance of indices may be more or less volatile than any investment strategy.

Performance results for Breckinridge’s investment strategies include the reinvestment of interest and any other earnings, but do not reflect any brokerage or trading costs a client would have paid. Results may not reflect the impact that any material market or economic factors would have had on the accounts during the time period. Due to differences in client restrictions, objectives, cash flows, and other such factors, individual client account performance may differ substantially from the performance presented.

All investments involve risk, including loss of principal. Diversification cannot assure a profit or protect against loss. Fixed income investments have varying degrees of credit risk, interest rate risk, default risk, and prepayment and extension risk. In general, bond prices rise when interest rates fall and vice versa. This effect is usually more pronounced for longer-term securities. Income from municipal bonds can be declared taxable because of unfavorable changes in tax laws, adverse interpretations by the IRS or state tax authorities, or noncompliant conduct of a bond issuer.

Breckinridge believes that the assessment of ESG risks, including those associated with climate change, can improve overall risk analysis. When integrating ESG analysis with traditional financial analysis, Breckinridge’s investment team will consider ESG factors but may conclude that other attributes outweigh the ESG considerations when making investment decisions.

There is no guarantee that integrating ESG analysis will improve risk-adjusted returns, lower portfolio volatility over any specific time period, or outperform the broader market or other strategies that do not utilize ESG analysis when selecting investments. The consideration of ESG factors may limit investment opportunities available to a portfolio. In addition, ESG data often lacks standardization, consistency and transparency and for certain companies such data may not be available, complete or accurate.

Breckinridge’s ESG analysis is based on third party data and Breckinridge analysts’ internal analysis. Analysts will review a variety of sources such as corporate sustainability reports, data subscriptions, and research reports to obtain available metrics for internally developed ESG frameworks. Qualitative ESG information is obtained from corporate sustainability reports, engagement discussion with corporate management teams, among others. A high sustainability rating does not mean it will be included in a portfolio, nor does it mean that a bond will provide profits or avoid losses.

Net Zero alignment and classifications are defined by Breckinridge and are subjective in nature. Although our classification methodology is informed by the Net Zero Investment Framework Implementation Guide as outlined by the Institutional Investors Group on Climate Change, it may not align with the methodology or definition used by other companies or advisors. Breckinridge is a member of the Partnership for Carbon Accounting Financials and uses the financed emissions methodology to track, monitor and allocate emissions. These differences should be considered when comparing Net Zero application and strategies.

Targets and goals for Net Zero can change over time and could differ from individual client portfolios. Breckinridge will continue to invest in companies with exposure to fossil fuels; however, we may adjust our exposure to these types of investments based on net zero alignment and classifications over time.

Any specific securities mentioned are for illustrative and example only. They do not necessarily represent actual investments in any client portfolio.

The effectiveness of any tax management strategy is largely dependent on each client’s entire tax and investment profile, including investments made outside of Breckinridge’s advisory services. As such, there is a risk that the strategy used to reduce the tax liability of the client is not the most effective for every client. Breckinridge is not a tax advisor and does not provide personal tax advice. Investors should consult with their tax professionals regarding tax strategies and associated consequences.

Federal and local tax laws can change at any time. These changes can impact tax consequences for investors, who should consult with a tax professional before making any decisions.

The content may contain information taken from unaffiliated third-party sources. Breckinridge believes such information is reliable but does not guarantee its accuracy or completeness. Any third-party websites included in the content has been provided for reference only. Please see the Terms & Conditions page for third party licensing disclaimers.