Securitized

Perspective published on May 26, 2021

Securitized SBA Loans Can Help Diversify a Bond Portfolio

Summary

- The Small Business Administration (SBA) supports small businesses financially and helps communities recover economically after disasters.

- America’s nearly 30 million small businesses create private sector jobs, employing more than half of the nation’s workforce.

- Securitized SBA loans can contribute to portfolio diversification and lower lending costs for institutions helping to finance growth of small businesses in their communities.

The Small Business Administration (SBA) plays an important economic development role by lending money to small businesses, often described as our economy’s primary growth engine.

America’s nearly 30 million small businesses create two out of every three net new private sector jobs and employ more than half of the nation’s workforce.1 Through capital support and business development programs, the SBA helps small businesses grow revenue and sustain jobs in their communities, in addition to supporting economic recovery following local disasters.

Small businesses historically have had less access to credit than large businesses.2 By securitizing SBA loans for investors, financial institutions can lower their lending costs, which can support expansion of their SBA lending activities. In addition, securitized SBA loans offer investors the chance to participate in the growth of SBA lending programs.

Small Businesses Are a Force in the American Economy.

The SBA’s definition of small business varies somewhat among sectors and industries, typically based on numbers of employees and receipts.3 The definition is meant to help small businesses across sectors secure SBA loans, win contracts with the government, and access general tools that can help them compete against larger corporations.

While the definition may vary, the role of small businesses in America’s economy is substantial. Goldman Sachs, in its 2019 report, The Voice of Small Business in America, cited the SBA’s Office of Advocacy when it reported, “Small businesses comprise 99% of all employer firms and employ nearly half of the American workforce.”

Securitized Loans Are a Key Segment of the Bond Market

Securitized bonds can be meaningful diversifiers in a fixed income portfolio. Largely comprised of asset-backed securities (ABS) and mortgage-backed securities (MBS), securitized bonds are created by pooling a group of financial assets and then selling slices of them to investors, thereby providing exposure to a variety of the underlying assets.

Securitization frees up a financial institution’s regulatory capital -- the assets that banks are required to hold by their financial regulators to remain solvent. In addition, securitization can offer issuers higher credit ratings and lower borrowing costs.

MBS can be backed by either residential or commercial mortgages. ABS are backed by non-mortgage-related financial assets, such as auto loans, student loans and credit card receivables. Securitized SBA loans are another less-well-known form of securitized assets.

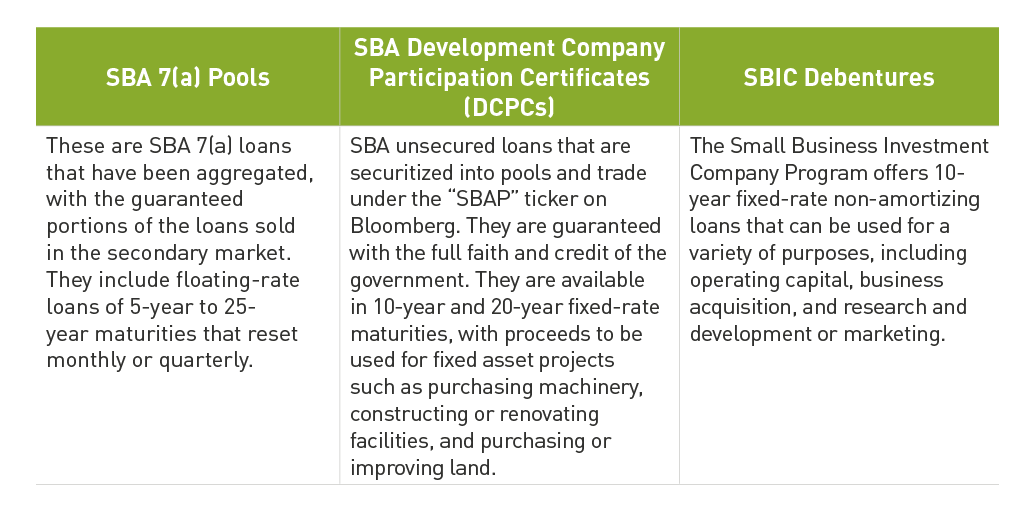

Three Main Forms of Securitized SBA loans

Securitized SBA loans in the market can take three main forms:

An active secondary market for securitized SBA loans means that lenders can consistently sell the guaranteed portion of a SBA loan, increasing a lender’s liquidity position and enabling more loans issuance.

All three types of securitized SBA loans are structured as single-class, pass through certificates, so all loans have the same place in the cash flow waterfall. In other words, there are no tranches that would create a senior or subordinated form of debt.

Aside from fixed vs floating rate and maturity tenors, the key differences between different SBA bonds are liquidity and the embedded prepayment protection features built into the bonds. The DCPC’s for example have a prepayment penalty feature that is passed along to the investor whereas the others do not have this same protection. The DCPC’s are the largest and most liquid among the three programs and have a regular primary issuance calendar slot every month. The others tend to issue smaller, more one-off deals in the market.

Benefits and Risks of Securitized SBA Loans*

Conclusion: Securitized SBA Loans Could Add Value to Many Portfolios

Through securitization, certain risks in the underlying securities are mitigated by the pooling of these assets. Additionally, in a fixed-income portfolio that is focused on either corporate or other government debt, including ABS and MBS issues, securitized SBA loans may offer a distinct and complementary source of yield and risk. That can provide a degree of diversification through relatively low correlation with these other assets.

At Breckinridge, we seek to build diversified, customized bond portfolios that can counterbalance riskier assets in periods of economic distress and uncertainty. When appropriate, we will consider securitized SBA loans for client portfolios.

In conclusion, we believe securitized SBA loans can diversify portfolios, offering an additional source of government-guaranteed yields.

*Diversification does not guarantee a profit or protect against a loss in a declining market. It is a method used to help manage investment risk.

#252686 (Rev 5/19/21)

[1] SBA Reimagined: Powering the American Dream, Small Business Administration FY 2018-2022 Strategic Plan.

[2] The Federal Reserve Bank of San Francisco, https://www.frbsf.org/economic-research/publications/economic-letter/2011/july/securitization-small-business/. July 2011.

[3] U.S. Small Business Administration, https://www.sba.gov/document/support--table-size-standards, 2019.

DISCLAIMER

This material provides general and/or educational information and should not be construed as a solicitation or offer of Breckinridge services or products or as legal, tax or investment advice. The content is current as of the time of writing or as designated within the material. All information, including the opinions and views of Breckinridge, is subject to change without notice.

Any estimates, targets, and projections are based on Breckinridge research, analysis, and assumptions. No assurances can be made that any such estimate, target or projection will be accurate; actual results may differ substantially.

Past performance is not a guarantee of future results. Breckinridge makes no assurances, warranties or representations that any strategies described herein will meet their investment objectives or incur any profits. Any index results shown are for illustrative purposes and do not represent the performance of any specific investment. Indices are unmanaged and investors cannot directly invest in them. They do not reflect any management, custody, transaction or other expenses, and generally assume reinvestment of dividends, income and capital gains. Performance of indices may be more or less volatile than any investment strategy.

Performance results for Breckinridge’s investment strategies include the reinvestment of interest and any other earnings, but do not reflect any brokerage or trading costs a client would have paid. Results may not reflect the impact that any material market or economic factors would have had on the accounts during the time period. Due to differences in client restrictions, objectives, cash flows, and other such factors, individual client account performance may differ substantially from the performance presented.

All investments involve risk, including loss of principal. Diversification cannot assure a profit or protect against loss. Fixed income investments have varying degrees of credit risk, interest rate risk, default risk, and prepayment and extension risk. In general, bond prices rise when interest rates fall and vice versa. This effect is usually more pronounced for longer-term securities. Income from municipal bonds can be declared taxable because of unfavorable changes in tax laws, adverse interpretations by the IRS or state tax authorities, or noncompliant conduct of a bond issuer.

Breckinridge believes that the assessment of ESG risks, including those associated with climate change, can improve overall risk analysis. When integrating ESG analysis with traditional financial analysis, Breckinridge’s investment team will consider ESG factors but may conclude that other attributes outweigh the ESG considerations when making investment decisions.

There is no guarantee that integrating ESG analysis will improve risk-adjusted returns, lower portfolio volatility over any specific time period, or outperform the broader market or other strategies that do not utilize ESG analysis when selecting investments. The consideration of ESG factors may limit investment opportunities available to a portfolio. In addition, ESG data often lacks standardization, consistency and transparency and for certain companies such data may not be available, complete or accurate.

Breckinridge’s ESG analysis is based on third party data and Breckinridge analysts’ internal analysis. Analysts will review a variety of sources such as corporate sustainability reports, data subscriptions, and research reports to obtain available metrics for internally developed ESG frameworks. Qualitative ESG information is obtained from corporate sustainability reports, engagement discussion with corporate management teams, among others. A high sustainability rating does not mean it will be included in a portfolio, nor does it mean that a bond will provide profits or avoid losses.

Net Zero alignment and classifications are defined by Breckinridge and are subjective in nature. Although our classification methodology is informed by the Net Zero Investment Framework Implementation Guide as outlined by the Institutional Investors Group on Climate Change, it may not align with the methodology or definition used by other companies or advisors. Breckinridge is a member of the Partnership for Carbon Accounting Financials and uses the financed emissions methodology to track, monitor and allocate emissions. These differences should be considered when comparing Net Zero application and strategies.

Targets and goals for Net Zero can change over time and could differ from individual client portfolios. Breckinridge will continue to invest in companies with exposure to fossil fuels; however, we may adjust our exposure to these types of investments based on net zero alignment and classifications over time.

Any specific securities mentioned are for illustrative and example only. They do not necessarily represent actual investments in any client portfolio.

The effectiveness of any tax management strategy is largely dependent on each client’s entire tax and investment profile, including investments made outside of Breckinridge’s advisory services. As such, there is a risk that the strategy used to reduce the tax liability of the client is not the most effective for every client. Breckinridge is not a tax advisor and does not provide personal tax advice. Investors should consult with their tax professionals regarding tax strategies and associated consequences.

Federal and local tax laws can change at any time. These changes can impact tax consequences for investors, who should consult with a tax professional before making any decisions.

The content may contain information taken from unaffiliated third-party sources. Breckinridge believes such information is reliable but does not guarantee its accuracy or completeness. Any third-party websites included in the content has been provided for reference only. Please see the Terms & Conditions page for third party licensing disclaimers.