Corporate

Commentary published on October 11, 2022

Q4 2022 Corporate Bond Market Outlook

Summary

- After raising the federal funds rate 150 basis points (bps) in the first half of 2022, the Federal Reserve (Fed) added 150bps more in the third quarter, and clearly signaled increases will follow.

- In the U.S., rising interest rates, prices, and wages in an exceedingly tight labor market framed behavior of the investment markets and corporate bond issuers.

- The International Monetary Fund lowered its baseline economic growth forecasts for 2022 and 2023, a sign that challenges are ahead for the global economy. (1)

- Balancing current business conditions with concerns for when economic growth might succumb to the Fed’s restrictive policies, corporate managements exhibited increasing wariness.

- Almost half of the S&P 500 companies used the word recession during earnings calls in the second quarter. (2)

- Uncertainty stemming from the list of concerns weighed on corporate bonds and stocks.

- IG fixed-rate supply of $336.5 billion was 1 percent higher than the prior quarter and almost 10 percent lower than same quarter in 2021. IG fund flows were positive at about $2 billion. (3)

- Breckinridge views corporate bond fundamentals as stable with a modest weakening bias, with second quarter earnings revealing material dispersion by sector.

- Scrutiny of environmental, social, and governance (ESG) approaches increased from regulators and politicians. Breckinridge maintained its stance that ESG in security analysis is additive to the effort to identify and understand the materiality of certain nonfinancial risks.

Investment Review and Outlook

July respite turns into retreat through August and September

The third quarter began with investment markets rallying. A June increase of 75 basis points (bps) in the fed funds rate appeared to give confidence to investors that the Federal Reserve (Fed) was willing to control inflation through aggressive interest rate hikes despite any potential recessionary effects that higher rates might cause.

In late July, the Federal Open Market Committee (FOMC) increased the fed funds rate by 75bps for the second consecutive month. Comments from Fed Chairman Jerome Powell, however, suggested to some that the central bank might be preparing to pivot from increasing rates. However, at the Fed’s August Jackson Hole, Wyoming Symposium, Chairman Powell corrected any misperception. He explicitly described the need for additional rate hikes and economic pain unless and until inflation is closer to the Fed’s 2 percent target. Due to the more hawkish tilt, investment markets declined in August.

Heightened volatility complicated the environment. The Merrill Lynch Option Volatility Estimate, a measure of bond volatility, reached its highest level of the year on September 28. Underlying the negative sentiment and attendant volatility was concern about the effectiveness of the Fed’s interest rate increases on inflation and the prospects for a recession. Incoming data, while sometimes conflicting, continued to point to a resilient economy that was not slowing.

Wages increased as employers found it difficult to fill job openings. Initial jobless claims fell. A mid-quarter uptick in the unemployment rate was due to an increase in labor force participation rather than employers reducing staff. Consumer confidence readings were solid throughout the summer. Revisions to prior data on retail sales suggest household spending on discretionary items held up even as the cost of non-discretionary spending on food and energy rose, Bloomberg (BBG) reported.

Treasury yields increased across the curve and a relatively mild inversion that emerged in the second quarter deepened as investors bid up short-term maturities. According to BBG data, Treasury yields in the 2- and 5- maturity year ranges were higher by 132bps and 105bps, respectively. Yields at 10 years were higher by 82bps and 59bps at 30 years.

Fundamentals

IG Credit Fundamentals Have Improved in Recent Years, but Face Challenges Ahead

We view credit fundamentals as stable but with a weakening bias. Leverage is slowly rising but could accelerate as the economy slows. The drop in mergers and acquisition (M&A) activity is a credit-positive that is partially offset by higher share buybacks.

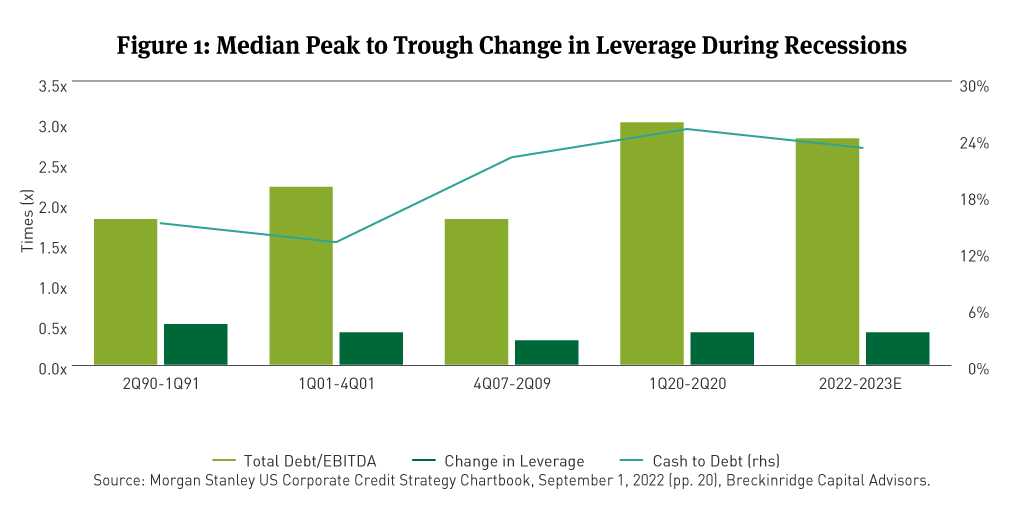

Leverage has troughed and agency outlooks and actions are now tilted negative. IG corporate debt leverage has risen in past economic recessions as earnings before interest, taxes, depreciation, and amortization (EBITDA) tends to drop faster than issuer debt obligations.

Looking at the past four U.S. recessions we observe that median IG gross leverage moved up 0.4 times, peak-to-trough (See Figure 1). With median gross leverage of 2.4 times for the IG cohort at 2Q22, history suggests leverage could peak at 2.8 times in 2023.

As an offset, it is also common for IG companies to build up cash during recessions, so the increase in net leverage may be lower (See Figure 1). Still, IG issuers are resilient and have big market shares and lots of levers to pull in a slower economic environment.

M&A deal count and values are down, as is debt financing. Global M&A volume was $642 billion between July and September, a 42 percent drop from the prior quarter and the lowest third quarter figure in a decade, per preliminary figures from Refinitiv.4

Share buybacks are up as companies support weak share prices The effect on future buyback activity of legislation that imposes a 1 percent excise tax on corporate net share repurchases beginning in 2023 is an unknown entering the fourth quarter of 2022 and during 2023.5

As FactSet observed, “Like so many pieces of legislation, this tax could spark unintended consequences such as a wave of corporate buyback authorizations and executions this year since the excise tax only applies to the market value of net corporate shares repurchased starting in 2023.”

A Quick Look: U.S. Banking Sector Fundamentals Still Look Sound

The U.S. banking industry reported solid net income of $64 billion in 2Q22, albeit a decline of 8.5 percent year-over-year (Y/Y).

Profitability, as measured by return on equity was 11 percent, allowing for good internal capital generation, down from 13 percent.

Credit quality, as measured by noncurrent assets to assets, remains stable and improved to 0.39 percent from 0.51 percent (See Figure 2).

Capital adequacy remains solid and well-above regulatory minimums. However, the trend is lower.

In the fourth quarter, all eyes will be on corporate earnings reports, as investors try to discern trends as shaped by ongoing rate increases. As The Wall Street Journal reported, “Analysts have cut earnings expectations for companies in the S&P 500 by the widest margin in more than two years.”6

Earnings-per-share (EPS) estimates for the S&P 500 decreased 6.6 percent between June 30 and September 29, based on the Q3 bottom-up an aggregate of analysts’ median EPS projections for all index constituents, according to FactSet. In contrast, FactSet noted, that more S&P 500 companies are issuing positive EPS preannouncements at a higher rate than usual lately ahead of their results. The apparent difference in the views of the analysts and managements will keep the focus on actual reports throughout the early weeks of the fourth quarter.

Technicals

Lower Refinancings, M&A Debt Offerings Drove 12 Percent Decline in IG Issuance through 3Q

We view technicals as a modest weakness. IG supply of $336 billion in Q2 was down 10 percent Y/Y, although the September tally of about $82 billion was down almost 50 percent Y/Y, per Bloomberg data.

IG bond fund flows were basically flat for the quarter but turned negative more recently in September with $17bn of outflows. But, the highest IG bond yields in over 10 years, could prompt inflows to pick up prospectively.

A drop in refinancing and M&A debt offerings have driven a 12 percent decline in IG issuance year-to-date (YTD).

Sharply higher interest rates and capital market volatility weighed on U.S. nonfinancial corporate debt issuance through 2022, said Fitch Ratings at the end of July. High-yield and investment-grade bond issues fell 26percent in the first half of 2022 compared with a year earlier, according to data from the Securities Industry and Financial Markets Association.7

Dealer inventories and an inability to warehouse bonds have weighed on market liquidity at times “Primary dealers’ combined holdings of investment-grade and high-yield bonds tumbled into negative territory in July, hitting a low of negative $2.17 billion for the week ending July 13, when dealers held net positions to sell bonds across both classes, data from the Federal Reserve Bank of New York show. A rolling four-week average hit its lowest level on record on July 27, at negative $550 million, Risk.net reported.8

Valuations

IG Spreads Still Near the Long-Term Mean but Opportunities Exist

We view current valuations as a modest weakness. At 159bps, the IG Index option-adjusted spread is 10bps wide to its mean since 1993. The inverted U.S. Treasury curve has created opportunities and corporate relative value can vary by quality and maturity. For instance, at current valuations, spreads on bonds rated BBB are over two standard deviations wide to bonds rated A in the 5-year but are in-line with their long-term average in the 30-year maturity.

We expect further volatility and some spread widening pressure based on inflation concerns, a hawkish Fed and uncertainly related to the timing of a potential economic recession. Pockets of value have emerged particularly in select IG issuers where intermediate, 5-year all-in yields are very close to 10-year yields (See Figure 3).

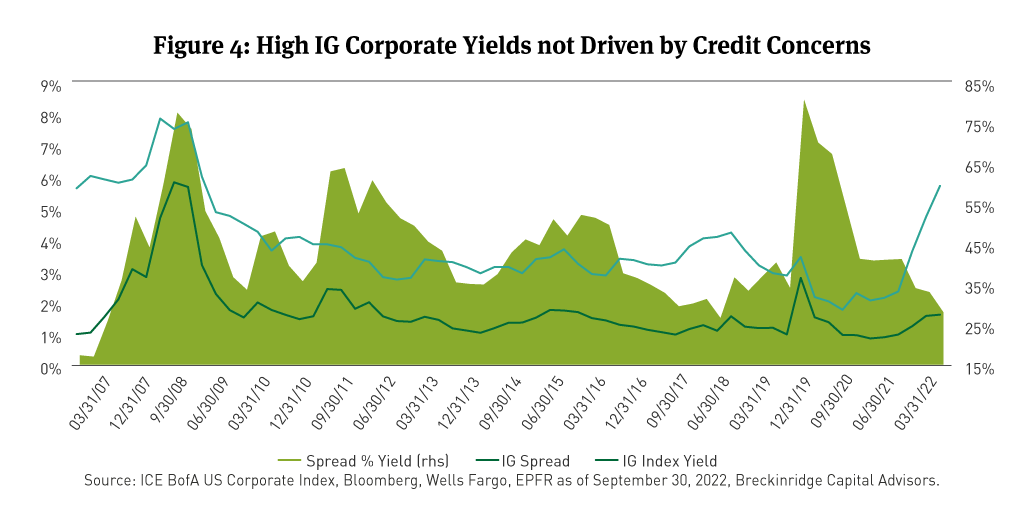

The highest corporate yields since 2009 have been driven primarily by the rise in rates orchestrated by the Fed. At around 5.5 percent, the current yield on the ICE BofA ML IG Corporate Index is at its highest level since the middle of 2009. Reflecting acute credit distress, the credit spread as a percent of the IG corporate yield peaked at 80 percent in both 2020 and 2008. Today, the Index yield is akin to 2009 but the rate component is well above the spread suggesting stable credit fundamentals (See Figure 4).

A Look Back at IG Spreads during Economic Cycles over the Last 25 Years

The IG corporate market has endured three recessions and eight market shocks over the last 25 years. IG corporate excess returns typically turn positive during recession as the Fed cuts rates. Ex-recession, market shocks and volatility can be equally damaging to IG corporate excess returns.

BBB-rated corporate bonds have outperformed in 15 years of the last 25, with A-rated corporate bonds outperforming in 10 years. IG has seen two years of negative excess in a row three times: 1997-1998, 2007-2008, 2014-2015. YTD excess return for IG Corps (negative 357bps) is the fifth worst performance over the last 25 years. A normal pattern would be to see 2023 as a positive excess return year given the 2022 drawdown.

Current AA and BBB corporate spreads are slightly wide to their 100-year medians but are still well inside recessionary levels. BBB spreads at 192bps are consistent with growth/earnings slowdowns in 2019 and 2015, but not recessions or crisis (2020, 2012). We see potential opportunity in corporate bonds as all-in yields historically have spiked back to 2010-2011 levels, excluding the brief period in March/April 2020.

ESG Spotlight

Two ESG topics assumed higher profiles during the third quarter. First was increased scrutiny of the role of ESG analysis in investing. Second was the growth of net zero approaches to investing. Breckinridge expressed its points of view on both during the quarter.

ESG analysis in investing gained increased focus among politicians, regulators, and investment industry practitioners in 2022. Some politicians question its economic implications and more, while regulators work to increase disclosures. Meanwhile debate in the investment industry examines how ESG is applied, fees charged and its potential influences on risk management, returns, and corporate sustainability efforts.

For its part Breckinridge maintains the stance that it adopted more than a decade ago when it integrated ESG into its investment process. Driven by its investment research team, Breckinridge integrates material ESG issues to identify and assess long-term and idiosyncratic risks. You can read more about our views on commentaries from a range of perspectives in our ESG Newsletter article In 2022, ESG Perspectives Range from Political to Practical and Points In Between.

Net zero investing supports the goal of net zero greenhouse gas emissions by 2050 or sooner, in line with global efforts to limit warming to 1.5 degrees Celsius; and to supporting investing aligned with net zero emissions by 2050 or sooner. As reported (See Embarking Down the Long Road Ahead), Breckinridge signed onto the Net Zero Asset Managers Initiative in 2021.

During the third quarter, Breckinridge brought attention to additional steps it is taking to advance the net zero effort. First, the announced its membership in the Partnership for Carbon Accounting Financials (PCAF), which is furthering the global effort to bring greater consistency to measuring and disclosing financed greenhouse gas (GHG) emissions. You can learn more about this organization and Breckinridge’s role within it by reading Breckinridge supports GHG accounting standard commitment.

In addition, Breckinridge shared more about its own net zero strategy, which is currently available to clients. Additional insight to the strategy’s approach is provided in a recently published article titled There’s Nothing Passive About Net Zero Investing in Fixed Income.

[1] “Gloomy and More Uncertain,” International Monetary Fund, July 2022.

[2] “Highest Number of S&P 500 Companies Citing ‘Recession’ on Q2 Earnings Calls in Over 10 Years,” FactSet, September 9, 2022.

[3] EPFR Global, September 30, 2022.

[4] “Global M&A just suffered its worst Q3 in a decade,” Axios, September 30, 2022.

[5] “Stock Buybacks Under Attack: Tracking Share Repurchase Events Ahead of 2023,” FactSet, September 30, 2022.

[6] “Analysts Slash Q3 Earnings Expectations, But Many Companies Remain Positive,” The Wall Street Journal, September 30, 2022.

[7] “Corporate Bond Issues Fall More Than 25% Through Q2: Weekly Stat,” CFO, August 10, 2022.

[8] “Credit markets falter as dealers slash inventory,” Risk.net, August 19, 2022.

DISCLAIMER

This material provides general and/or educational information and should not be construed as a solicitation or offer of Breckinridge services or products or as legal, tax or investment advice. The content is current as of the time of writing or as designated within the material. All information, including the opinions and views of Breckinridge, is subject to change without notice.

Any estimates, targets, and projections are based on Breckinridge research, analysis, and assumptions. No assurances can be made that any such estimate, target or projection will be accurate; actual results may differ substantially.

Past performance is not a guarantee of future results. Breckinridge makes no assurances, warranties or representations that any strategies described herein will meet their investment objectives or incur any profits. Any index results shown are for illustrative purposes and do not represent the performance of any specific investment. Indices are unmanaged and investors cannot directly invest in them. They do not reflect any management, custody, transaction or other expenses, and generally assume reinvestment of dividends, income and capital gains. Performance of indices may be more or less volatile than any investment strategy.

Performance results for Breckinridge’s investment strategies include the reinvestment of interest and any other earnings, but do not reflect any brokerage or trading costs a client would have paid. Results may not reflect the impact that any material market or economic factors would have had on the accounts during the time period. Due to differences in client restrictions, objectives, cash flows, and other such factors, individual client account performance may differ substantially from the performance presented.

All investments involve risk, including loss of principal. Diversification cannot assure a profit or protect against loss. Fixed income investments have varying degrees of credit risk, interest rate risk, default risk, and prepayment and extension risk. In general, bond prices rise when interest rates fall and vice versa. This effect is usually more pronounced for longer-term securities. Income from municipal bonds can be declared taxable because of unfavorable changes in tax laws, adverse interpretations by the IRS or state tax authorities, or noncompliant conduct of a bond issuer.

Breckinridge believes that the assessment of ESG risks, including those associated with climate change, can improve overall risk analysis. When integrating ESG analysis with traditional financial analysis, Breckinridge’s investment team will consider ESG factors but may conclude that other attributes outweigh the ESG considerations when making investment decisions.

There is no guarantee that integrating ESG analysis will improve risk-adjusted returns, lower portfolio volatility over any specific time period, or outperform the broader market or other strategies that do not utilize ESG analysis when selecting investments. The consideration of ESG factors may limit investment opportunities available to a portfolio. In addition, ESG data often lacks standardization, consistency and transparency and for certain companies such data may not be available, complete or accurate.

Breckinridge’s ESG analysis is based on third party data and Breckinridge analysts’ internal analysis. Analysts will review a variety of sources such as corporate sustainability reports, data subscriptions, and research reports to obtain available metrics for internally developed ESG frameworks. Qualitative ESG information is obtained from corporate sustainability reports, engagement discussion with corporate management teams, among others. A high sustainability rating does not mean it will be included in a portfolio, nor does it mean that a bond will provide profits or avoid losses.

Net Zero alignment and classifications are defined by Breckinridge and are subjective in nature. Although our classification methodology is informed by the Net Zero Investment Framework Implementation Guide as outlined by the Institutional Investors Group on Climate Change, it may not align with the methodology or definition used by other companies or advisors. Breckinridge is a member of the Partnership for Carbon Accounting Financials and uses the financed emissions methodology to track, monitor and allocate emissions. These differences should be considered when comparing Net Zero application and strategies.

Targets and goals for Net Zero can change over time and could differ from individual client portfolios. Breckinridge will continue to invest in companies with exposure to fossil fuels; however, we may adjust our exposure to these types of investments based on net zero alignment and classifications over time.

Any specific securities mentioned are for illustrative and example only. They do not necessarily represent actual investments in any client portfolio.

The effectiveness of any tax management strategy is largely dependent on each client’s entire tax and investment profile, including investments made outside of Breckinridge’s advisory services. As such, there is a risk that the strategy used to reduce the tax liability of the client is not the most effective for every client. Breckinridge is not a tax advisor and does not provide personal tax advice. Investors should consult with their tax professionals regarding tax strategies and associated consequences.

Federal and local tax laws can change at any time. These changes can impact tax consequences for investors, who should consult with a tax professional before making any decisions.

The content may contain information taken from unaffiliated third-party sources. Breckinridge believes such information is reliable but does not guarantee its accuracy or completeness. Any third-party websites included in the content has been provided for reference only. Please see the Terms & Conditions page for third party licensing disclaimers.